Rebecca Lake is really a journalist with ten+ decades of working experience reporting on individual finance. She also assists with written content tactic for several brands.

The court will difficulty an automatic keep that could avoid most creditors from continuing to gather from you. Even court docket situations and trials associated with debt assortment must stop.

Along with purchasing all-around for the ideal mortgage, you may want to expend time shopping for the appropriate vehicle. Deciding on a decrease-priced automobile could make it simpler to place down a bigger down payment, which could assist you qualify for a far better vehicle loan.

Last of all, do extensive study! Nobody ought to finalize a mortgage from any source right up until they Examine the higher Enterprise Bureau, on the net assessments and in many cases regulatory bodies. Even the most beneficial financial institutions for auto financial loans really should bear this excellent Verify.

These types of debts are often called "nondischargeable debts." In advance of choosing to file, make certain that bankruptcy will "discharge" or eradicate sufficient bills to make it worthwhile.

This web site is really a absolutely free online resource that strives to supply practical articles and comparison attributes to our website visitors. We acknowledge advertising and marketing compensation from organizations that show up on the site, which can effect the location and get by which manufacturers (and/or their products) are introduced, and may also effects the rating that is assigned to it.

Move two: Get started Rebuilding Credit history Rebuilding credit score after bankruptcy usually takes time, plus the sooner you start out, the better. A number of the most effective solutions to rebuild credit history after bankruptcy include things like:

You will need to rebuild your credit score, generate a letter of rationalization, and pay down personal debt to get into the ideal posture for mortgage loan preapproval. Declaring bankruptcy signifies admitting that you’re unable to fork out your payments, and working out an arrangement to restructure or discharge your recent debts. Not shockingly, going bankrupt will make it rough to tackle any fresh financial debt — as well as a house loan is a large 1.

Insurance coverage items are governed from the conditions within the applicable insurance plan plan. Acceptance for Clicking Here protection, rates, commissions and costs, and various plan obligations are the only real duty on the underwriting insurance provider. The data on This web site does not modify any coverage plan terms in almost any way.

Chat with Qualified lawyers until eventually you’re satisfied. About any authorized challenge—from huge to small, and every thing in between.

Some parts of your life is going to be more challenging to barter for any calendar year or two after filing for bankruptcy, for instance leasing or leasing housing, funding a vehicle, and developing a bank account. So, It can be vital to have this stuff in find this place just before filing. And don't strategy on producing improvements Read Full Report quickly.

Chapter seven bankruptcy stays on credit score stories for ten years, when Chapter 13 bankruptcy sticks close to for 7 years. What this means is even nearly ten years after filing, probable creditors, lenders, landlords, utility firms and Many others legally permitted to watch your credit rating will be able to see the bankruptcy on your own report.

Wanting to develop your business or want input on the top small business credit card alternatives? We hold the answers you require.

Destructive details: Detrimental information and facts, which include late payments or high credit score utilization, can damage your rating. As you can’t dispute detrimental details that’s exact, you are able to detect and stop damaging patterns that may be dragging your score down.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Amanda Bearse Then & Now!

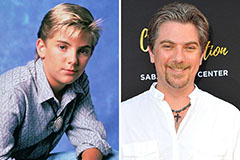

Amanda Bearse Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!